The Ultimate Guide to Choosing the Best Trading Platform for Forex

The Ultimate Guide to Choosing the Best Trading Platform for Forex

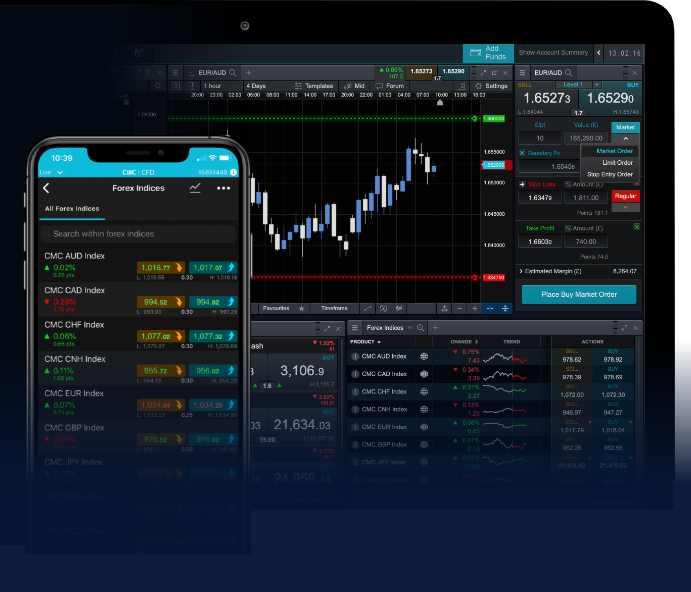

When diving into the world of forex trading, one of the most critical decisions a trader must make is selecting the right trading platform. A reliable and efficient platform can significantly enhance your trading experience, making it easier to analyze the market, execute orders, and manage your investments. In this guide, we will explore the best trading platforms for forex, discuss their key features, and provide insights into what makes them stand out in a crowded marketplace. You can start your journey by visiting best trading platform for forex forex-exregister.com to gather more information about prospective platforms.

Key Features of a Quality Forex Trading Platform

Before delving into specific platforms, it’s essential to understand the features that set the best forex trading platforms apart. Here are some key factors to consider:

- User-Friendly Interface: The best platforms offer intuitive designs that make navigation effortless. A cluttered interface can lead to mistakes during trading.

- Advanced Charting Tools: Look for platforms that provide comprehensive charting capabilities, including various indicators and drawing tools, which help in technical analysis.

- Real-Time Data: Access to real-time market data is crucial for making informed trading decisions. Choose a platform that provides timely information on price changes and transactions.

- Automated Trading Features: Many traders benefit from automation tools, such as Expert Advisors (EAs), which can execute trades on your behalf based on predefined criteria.

- Security Measures: A reliable platform should prioritize your safety, employing encryption and other security features to protect your sensitive information.

- Customer Support: Efficient customer service can resolve issues quickly and provide guidance when necessary, making it an essential feature of a trading platform.

Top Forex Trading Platforms

1. MetaTrader 4 (MT4)

MetaTrader 4 has become synonymous with forex trading due to its extensive range of features. It offers a user-friendly interface, advanced charting tools, and the ability to automate trades. It’s the go-to platform for many professional traders due to its flexibility and robust analytical capabilities.

2. MetaTrader 5 (MT5)

Building on the success of MT4, MetaTrader 5 includes additional features such as more timeframes, new order types, and an improved interface. It’s designed not only for forex trading but also allows for trading a wide range of other financial instruments, making it suitable for those who want to diversify their portfolio.

3. cTrader

cTrader has gained popularity for its intuitive design and advanced trading capabilities. It offers a range of charting tools and allows for one-click trading, which is ideal for active traders and scalpers looking to capitalize on market movements swiftly.

4. NinjaTrader

NinjaTrader is not only a forex trading platform but also a comprehensive trading software for futures and stock traders. Its powerful analytical features, customizable charting, and extensive community support make it a preferred choice for serious traders.

5. Forex.com

Forex.com is a brokerage firm that provides an excellent trading platform tailored for retail traders. It combines a user-friendly interface with professional-grade tools and features. Its strong regulatory standing also instills confidence among users.

How to Choose the Right Trading Platform

While the above platforms offer some of the best features, selecting the right one comes down to your specific trading needs and preferences. Here are some tips to guide your decision:

- Define Your Trading Style: Are you a day trader, swing trader, or a long-term investor? Your trading style will dictate the type of platform that suits you best.

- Test Usability: Many platforms offer demo accounts. Take advantage of these to explore the functionalities and interface before committing to a real account.

- Check Regulatory Compliance: Ensure that the trading platform is regulated by relevant financial authorities to provide a layer of safety and security.

- Evaluate Costs: Consider the fees associated with trading on the platform, such as spreads, commissions, and withdrawal fees. A lower cost can enhance your profitability.

- Read Reviews: Look for feedback from other traders regarding their experiences with the platform. User reviews can provide insight into the platform’s strengths and weaknesses.

Conclusion

Selecting the best trading platform for forex is a critical step that can significantly influence your trading success. By focusing on the platform’s features, testing usability, ensuring regulatory compliance, and evaluating costs, you can make an informed decision that aligns with your trading strategy. Take the time to explore various options and find a platform that suits your needs, ensuring a smoother and more profitable trading experience.